Income Tax Returns (ITR's) & Income Tax Slab

Know what is Income Tax ?

Know what is Income Tax ? Generally, income tax is an annual tax charged on an individual's earnings. Based on the amount of income earned over the course of a fiscal year, you have to pay tax. Online payments are available for income tax filing, TDS/TCS filing, and Non-TDS/TCS filing. To use these services, taxpayers need to enter the relevant information. Once information is entered, the process is simple.Know who should pay Income Tax ?

In a financial year, filing an ITR is mandatory if an individual's gross total income exceeds ₹ 2,50,000. Senior citizens are allowed a maximum of ₹ 3,00,000 and super senior citizens are allowed a maximum of ₹ 5,00,000. Taxes must be paid and income tax returns filed by the entities listed below:

All residents earning over ₹ 2.5 lakh annually shall be subject to income tax for FY 2021-22. An individual who earns more than ₹ 10 lakh p.a. will have to pay a tax of 30% of their earnings plus 4% cess.

- Artificial Judicial Persons

- Corporate firms

- Association of Persons (AOPs)

- Hindu Undivided Families (HUFs)

- Companies

- Local Authorities

- Body of Individuals (BOIs)

What is Income Tax Slab ?

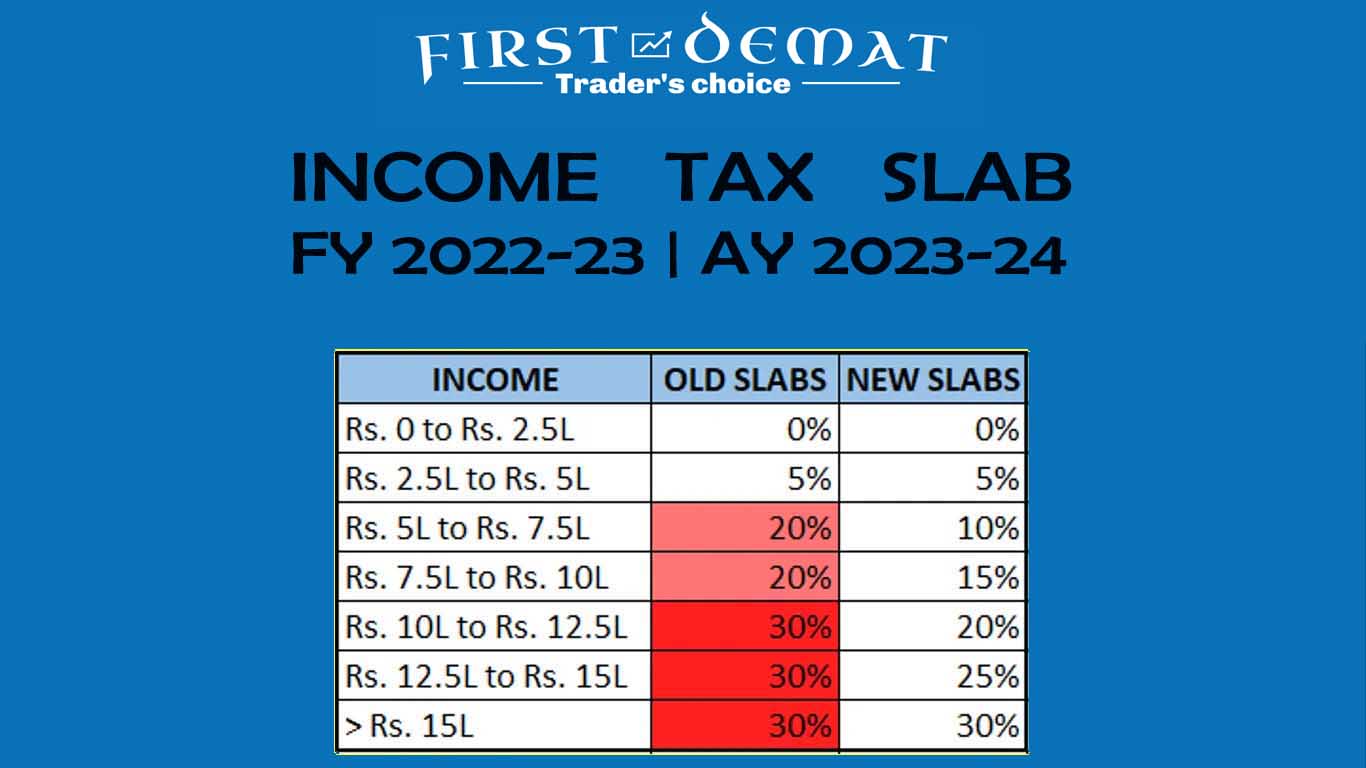

Depending on which tax slab system the individual taxpayer falls under, they are required to pay income tax. An individual's income may determine which tax bracket he/she falls under. Thus, higher income earners must pay more tax. It was introduced to ensure an equitable tax system in the country. A new tax slab is introduced at every budget announcement.

Taxpayers and Income Tax Slab Rates

Finance Ministers in India announce income tax slabs annually. In India, there are currently two different income tax regimes. Tax benefits will not be offered under the upcoming regime. Previous taxpayers were able to take advantage of tax benefits. The existing income tax slabs and tax rates have not been revised or changed in the Union Budget 2023, which was announced on 1 February 2023. Individuals and entities are taxed on their income directly. Based on the income slabs predefined by the IT Department, the tax is calculated on the entity's next taxable income. Note: The new Income Tax Portal is now available for filing your taxes. There are a number of features included in the portal, which is designed to make filing easier.

New income tax slabs were announced by the Finance Minister of India in the Union Budget 2023. Tax filers can choose to opt for the new income tax regime or to continue filing their taxes according to the old one.

This year, the finance minister Nirmala Sitharaman has announced the Union Budget for 2023 on 1 February 2023. In the latest budget, no changes have been proposed for the existing income tax slabs and rates.

Note: You can now file your taxes through the New income tax portal. The new portal comes with a plethora of features and is designed to ease the tax filing process.

Income Tax slab under New tax regime for FY 2023-24 & AY 2023-24

| Income Tax Slab | Tax Rate |

|---|---|

Up to ₹ 2,50,000 |

Nil |

From Rs.2,50,001 to Rs.5,00,000 |

5% |

From Rs.5,00,001 to Rs.7,50,000 |

10% |

From Rs.7,50,001 to Rs.10,00,000 |

15% |

From Rs.10,00,001 to Rs.12,50,000 |

20% |

From Rs.12,50,001 to Rs.15,00,000 |

25% |

Income above Rs.15,00,001 |

30% |